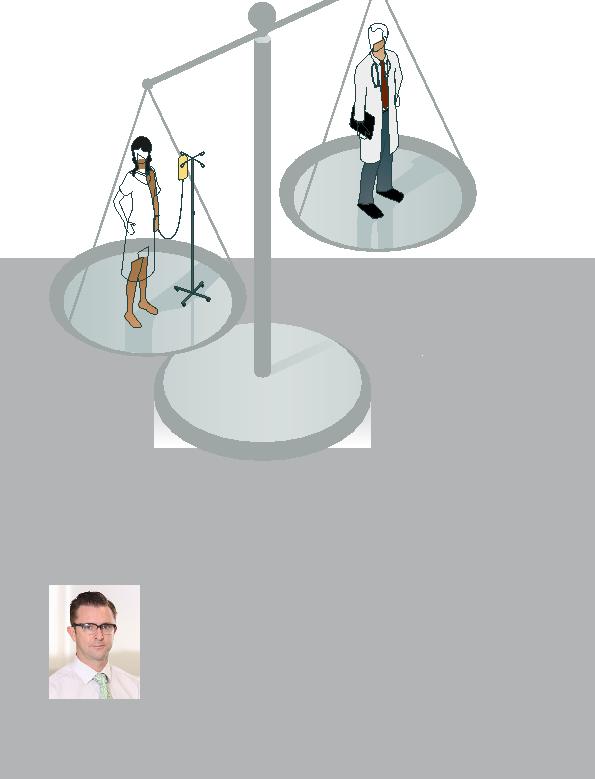

colleague who has been sued by a person

who claims they have suffered loss as a

result of the professional activity of the

doctor. There have been many cases and it is

highly recommended that doctors should be

appropriately insured.

advice from professionals who do not keep

up to date with changes in the law. Here

we will consider two areas where doctors

may want to check that their current

arrangements are in line with the latest

version of the law, along with the attitude

of the Commissioner of Taxation.

v Janmor Nominees Pty Ltd

trust as well as a corporate trustee, Janmor

Nominees Pty Ltd, to protect his assets. Mr

Justice Murphy, in the Supreme Court of

Victoria, stated: "Mr Redman believed by

establishment of the trust arrangement, he

could inter alia avoid the risk of personal

ruin should any `malpractice' suits be

brought against him personally.

in the Frankston and Malvern areas in

Victoria. He also believed that by means of

the trust he could be somewhat relieved of

with current law?

of de Groots Lawyers.