bulk bill so common sense tells us it

is also part of the very same service

if you don't bulk bill. Therefore you

would not separate the bandage and

the consultation on your patient claim

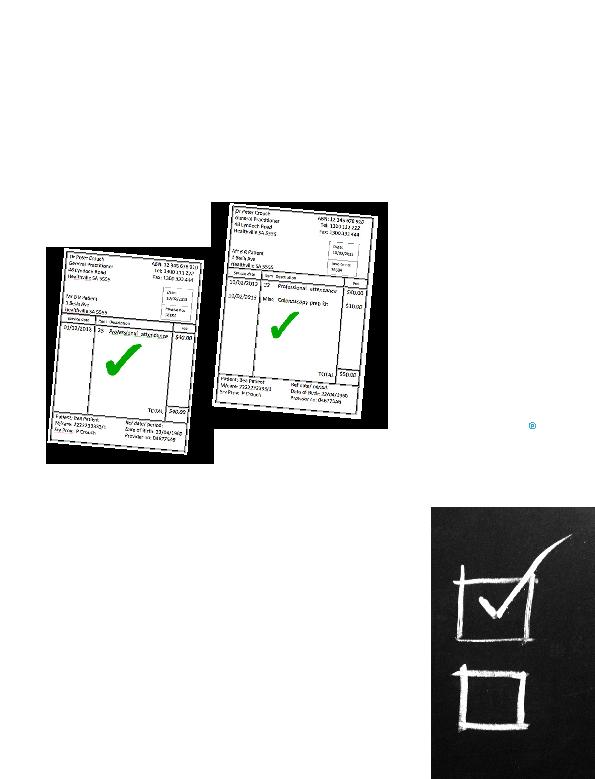

invoice. Instead, it would look like this:

prep kit?

Just to throw a spanner in the

works, what if you have consulted

a patient who presented with a leg

ulcer and your consultation involved

the examination and treatment of

that ulcer (including dressing it), but

then, just as you were finishing up,

the patient said she was having that

colonoscopy you ordered next week

and wondered if you might sell `those

prep kits', which of course you do.

intend to invoice as item 23 for the

ulcer consultation, which was why the

patient came to see you?

to the leg ulcer, so it should not be

added to the total fee for the item 23.

The colonoscopy prep kit should be

itemised separately, as follows:

there really is no need. Everything can

go on the one invoice when you are

doing patient claims and this will still

be fully compliant with the legislation.

clinically relevant services are a

private matter between the doctor and

the patient, and such services should

not be billed to Medicare. As long

as you are not adding inappropriate

extras to the MBS item numbers,

all will be well. Medicare will simply

ignore the items described as `Misc'

(or whatever other description your

practice uses) when they receive the

claim from the patient.

numbers, as it foots much of the bill

patient have agreed upon under your

private contractual arrangement.

Conversely, however, the full amount

you charge for your service must

be included on the invoice and be

disclosed to Medicare that's the

law. So, if you routinely charge your

patients $100 for item 23, this

amount must be fully disclosed to

Medicare on your invoice for that

item number.

mention: Medicare is a fee-for-service

scheme, which means that, subject to

the odd exception, if you provide more

than one service to your patient on the

same day, you can bulk bill one and not

the other. But that's another story.