PAGE 6

|

LSTAR ANNUAL GENERAL REVIEW 2022

President's Report

RANDY PAWLOWSKI

2022 LSTAR President

THE 2022 REAL ESTATE MARKET

The year started incredibly strong, with January and February recording robust numbers of home sales and steady climbs

in the average home sales price. The average sales price was more than $825,000 in February, achieving a new record

in the history of the Association. By the end of the year, the dynamics of the local housing market had drastically changed,

fueled by the Bank of Canada raising its benchmark rate seven times between March and December.

The higher borrowing costs made a huge impact on real estate across LSTAR's jurisdiction, the province of Ontario and

the rest of Canada. The affordability challenges and marketplace uncertainty saw local buyers pushing the pause button

on home purchases, while potential sellers showed reluctance to list their properties.

In December, the LSTAR average home price had dropped to $612,000, with a total of 7,639 homes sold throughout

2022, the second lowest number of home sales since 2012.

In 2022, the overall average sales price across the region was $724,583 up 13.3% from 2021. By geographic area,

London South (which includes data from the west side of the city) was $721,616 up 11% from the previous year. In

London North, average home sales price was $844,840 up 13.3% compared to 2021, while in London East, it was

$572,488, an increase of 14.2%. In St. Thomas, it was $628,096 up 12.8% over 2021.

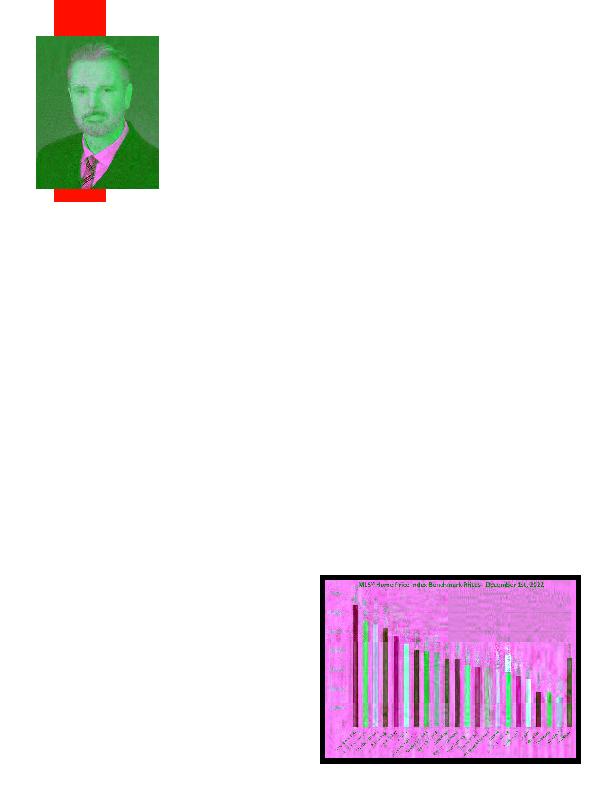

Meanwhile, the MLS® Home Price Index (HPI) benchmark price for 2022 was $566,600 down 15.1% from the previous

year. The benchmark price reflects the value of a "typical home" as assigned by buyers in a certain area based on various

housing attributes. Average sales price is calculated by adding the sales prices for all the homes sold and dividing that

total by the number of transactions. The HPI benchmark price is a more accurate way to gauge price trends over time,

since monthly averages may be skewed by the type of houses sold in that timeframe.

There were a total of 14,126 home listings, up 10.4% from 2021. Inventory (called Active Listings) was up 129.6% from

the previous year.

The following chart shows MLS® HPI benchmark prices

courtesy of the Canadian Real Estate Association (CREA),

providing a snapshot of how home prices in London and

St. Thomas compared to other major Ontario and

Canadian centres.

According to a research report by Altus Group, a total of

$73,250 in ancillary expenditures is generated by the average

housing transaction in Ontario over a period of three years

from the date of purchase. Based on the total sales for 2022,

that translates into potentially generating more than $559

million back into the local economy between 2022 and 2025.