1 0 · d e t e k t o r i n t e r n a t i o n a l

Security News Every Day

www. securityworldhotel.com

security

technology market

shift analogue boxes

whilst their share of the

market declines.

Market Growth

by Sector & Region

The total value of world

production of products

at factory gate prices

in 2012 was $20.57

billion. Of this video

surveillance products

at $10 billion increased

their share to 49%,

access control at $4.8

billion took a 23.5% share and

intruder alarms at $5.77 billion

had a 27.5% share.

The developed markets of

North America and Europe are los-

ing market share to Asia and par-

ticularly China which will be the

largest single market before the end

of this decade. Asia has increased its

share to over 35% for all physical

security systems, whilst growth has

been much more modest in North

America and Western Europe with

an aggregate increase of 6 / 7% and

3.5% respectively over the last 3

years. This trend will continue well

into the next decade.

The measure of penetration

of physical security products in

any country is an important factor

with system integrators to develop

solutions that work across differ-

ent vertical markets that add value

not just for improving security but

to increase operating efficiencies.

Improved ROI through IP

IP networking products can

offer much more than analogue

when they are joined with other

building services and the business

enterprise and these additional

benefits for the end user have defi-

nitely increased demand because

they deliver a much improved

ROI. There is no reason why the

traditional distributor route can-

not deliver the same service but

most distributors have not seen

the need to change and prefer to

alliances. But the main driver is

that they are delivering products

and systems that are transforming

the security industry from a cost

centre to a cash generator.

The business has also benefit-

ted from IT and communications

and defence companies continued

foray into the security industry

leveraging their expertise in digital

technology and making serious

inroads into homeland security

and transport markets.

Manufacturers partnering

with system integrators

The second structural change that

has contributed to getting more

from seemingly less is that the

routes to market have changed

with system integrators now tak-

ing some 50% of all product sales.

Manufacturers are now partnering

IMF projections for the rate of

GDP growth across advanced

countries in 2012 is 1.4% whilst

the world market for physical se-

curity systems grew by 6% a mul-

tiple of approximately 4.3. Even

allowing for much higher rates of

growth in emerging and developed

economies this is much more than

a worthy performance particularly

for a mature industry.

The growth continues

It also masks the fact that video

surveillance achieved 11.8%, dou-

ble the rate of aggregate growth

for the industry and access control

7.2%. Variation in performance

across subsectors is even wider

with IP video surveillance topping

the performance charts at around

30%. How this was made possible

is one of the main themes in the

4th Edition of "The Physical Secu-

rity Market 2012" by Memoori.

The main reason that this sec-

tor has been able to prosper dur-

ing the worst trading conditions

for decades is that the structure of

the business has morphed not just

to compensate but to meet and

beat the challenge.

From cost centre

to a cash generator

The 2012 Annual Report shows

that both the middle strata and

small companies have both

increased the size of the market

and their share. The minnows are

taking on the sharks and winning,

both through the development

of leading edge products and

growth through acquisition and

ThePhysicalSecurityMarket2012report:

Continuous growth despite

harsh economic times

security industry restructures to meet new challenges

Memoori is now releasing "The Physical Security Mar-

ket 2012" giving a valuable insight into global indus-

try that is very much influenced by not only techno-

logical developments but also by global changes for

the business sphere in general.

Jim Machale, market analyst at Memoori, has

written a summary of the report for detektor, based

on interviews and actual events that took place

during 2012.

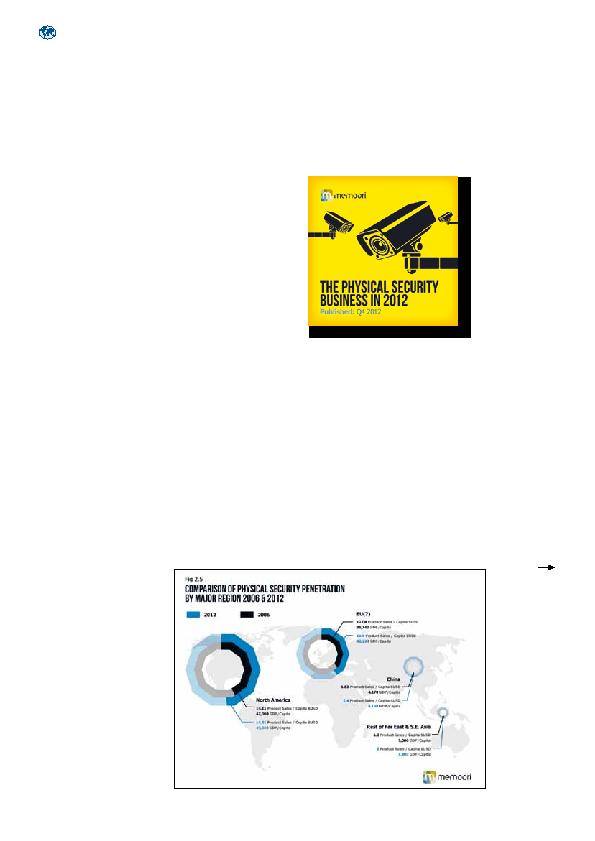

Fig 2.5

The penetration of

physical security products

is highest in North

America where GDP

per capita is forecast at

$49,340 and security

sales per capita $14.81.

In the EU(7) GDP

per Capita is projected

at $42,240 and secu-

rity sales per capita at

$11.5.

In China the GDP

per capita in 2012 is

projected at $6,120,

and sales per capita

was $2.4 showing that

the potential for future

growth is enormous.