skills, the Bank of Ocean City has

teamed up with Stephen Decatur

High School (SDHS) and EverFi

to offer an e-platform course.

instill financial skills in young ad-

ults that can be taken out of the

classroom and applied to the real

world.

big part of the bank's community

involvement," said Bank of Ocean

City President and CEO Wayne

Benson. "Educating our youth to

make intelligent financial deci-

sions on their own sets a solid

foundation on which they can

build upon their lifetime."

new media technologies" like 3-D

gaming, social networking, and

adaptive-pathing, to encourage

the understanding of finance and

economics. The EverFi platform

promises "interactive financial

management" that can be taken

from the screen out into the street.

Ocean City Assistant Vice Pres-

ident Earl Conley. "Instead of hav-

ing a teacher up there just writing

on a blackboard, you actually go

in ... It's very interactive. They

start everything from opening a

bank account to going through

and paying for college, your car

and your house. It's a pretty neat

program."

the practical information covered

by the course was a lot more than

she expected to find in an eco-

nomics class.

ing, investing, consumer fraud, col-

lege and all of that," explained

you'll need to know, not just for the

classroom but what you'll actually

use outside."

both of whom were satisfied with

the course.

teaching, assessing and certifying

students in a variety of financial

topics including credit scores, in-

surance, credit cards, student

loans, mortgages, taxes, stocks,

savings, 401k's and other critical

concepts," according to a release

from the Bank of Ocean City.

Completion of the course results

in the issuance of a Certification in

Financial Literacy, which EverFi

called a "powerful tool" in college

applications or resumes.

program in years to come, which

Conley said should give local stu-

dents an edge as state require-

ments continue to tighten.

stricter each year so this at least

covers far above and beyond what

the restrictions are," he stated.

ly good fit" and one the bank will

continue in the future. The bank

will be providing EverFi free-of-

charge to the school and Bank of

Ocean City is the first bank in the

state to move forward with the

EverFi course.

fee of $4,000 annually for the

product, which fulfills the school's

financial literacy requirements as

mandated by the government,"

said Conley.

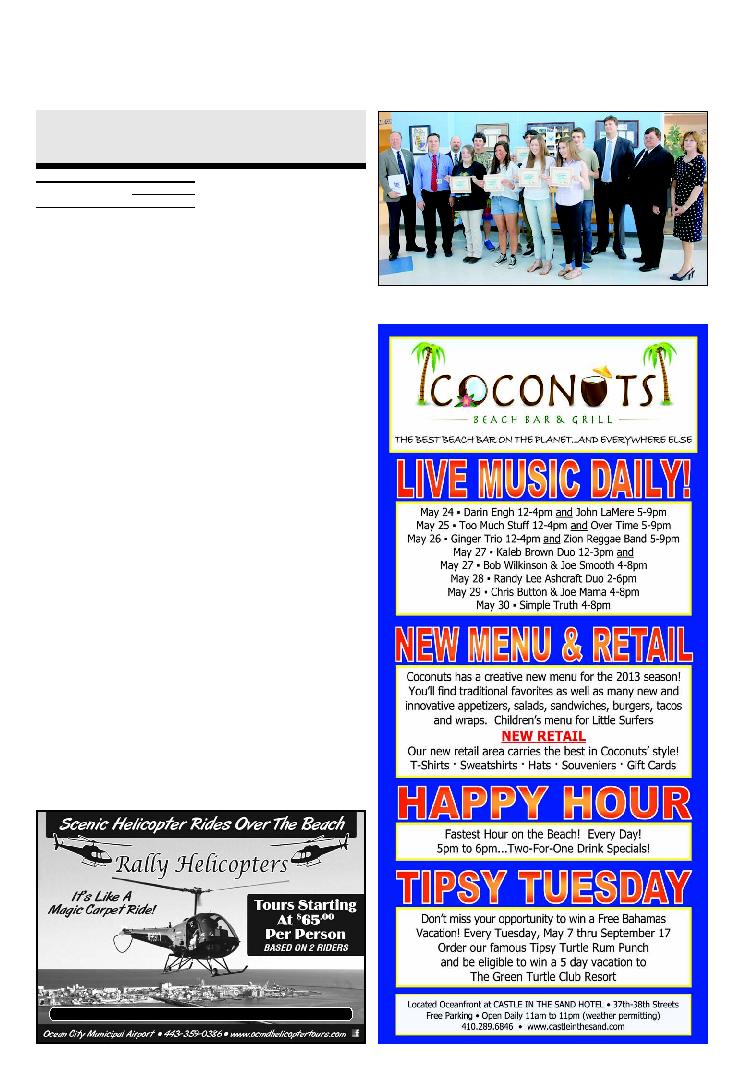

pletion Monday. Several of the

first-year members, including the

Wellman sisters, expressed in in-

terest in entering finance or bank-

ing professionally.

program this year.