Saltus's cash position increased over the year by $528,021,

propped up again this year by collections on past accounts

receivable. Cash flows from operating activities resulted in a

positive effect of $1,583,990 on cash. School fees receivable

net of allowance for doubtful accounts decreased $51,802

from 2011 to $134,505, while allowance for doubtful accounts

decreased a further $70,110 year over year. other receivables

were insignificant at year end, while prepaid assets, comprised

of prepaid insurance and prepaid curriculum expenses, were

$535,289.

in an asset base decrease of $244,685 at year end. Net capital

assets were $19,255,009 at year end.

the operating Fund, $5,445 in the Bursary and Endowment

Fund and accrued interest on the Centennial Trust in the

Building Fund which again increased in the current year,

ending the year at $1,901,123. Prepaid student accounts were

in line with the prior year at $1,218,870.

balance, therefore any donations received during the year in

this fund were immediately recognised in revenue to partially

offset the interest and depreciation which continue to be

incurred on the buildings. This resulted in a $746,551 loss in

the Building Fund in the current year and will continue to

have a significant effect on operating results in future years as

interest and depreciation continue to be incurred on the assets.

Saltus continuously strives to offer the best education for

money on the Island and, as an accredited member of CAIS

(Canadian Accredited Independent Schools), Saltus has the

opportunity to take part in a benchmark study annually. The

comparison schools are Canadian institutions, which will

account for some of the variance in results, but on the whole,

the results help Saltus gain on its strengths and focus on areas

in need of improvement.

per student, however, are slightly higher than the median.

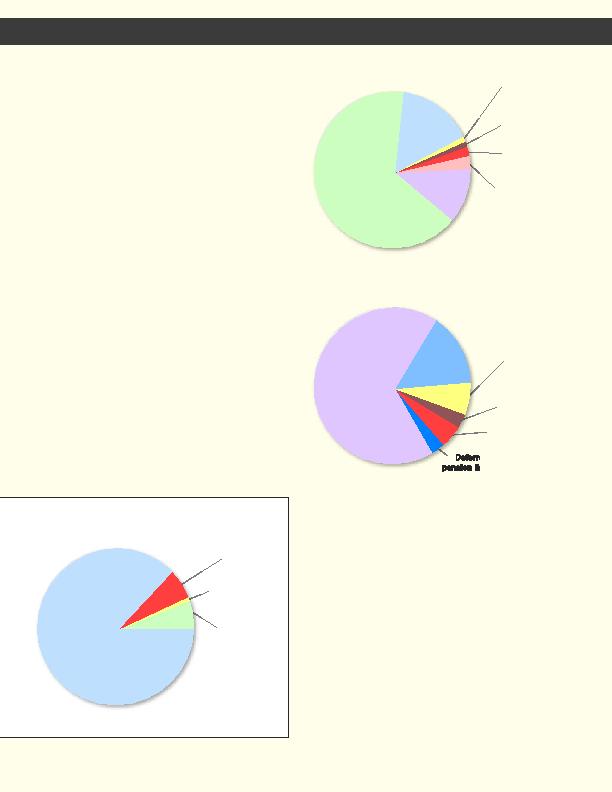

Salaries compose 78 percent of operating costs and therefore it

stands to reason that Saltus's operating costs would exceed the

median based on the higher cost of living in Bermuda and the

accompanying higher salary scale. When looking at fees, in