40

GA

/ Vol. 5 / No. 2 / FEBRUARY 2013

Soaring to new

heights:

The rise of

the global

rotorcraft

market

In the scope of both civil and mili-

tary aviation, the global helicopter

market is set to maintain the tena-

cious growth it has experienced

over the past five years. Indeed,

current forecasts suggest that by

2017 the industry will be worth an

estimated $24.7 billion. Underly-

ing the surge in demand for new

rotorcraft has been the broadened

appetite for helicopter use in vari-

ous growth sectors of the global

economy. Moreover, the replace-

ment cycles of aging helicopter

fleets are being propelled by rising

levels of disposable income in

emerging markets. For expanding

and newly established helicopter

operators, ensuring the effective

long-term service of rotorcraft

will require, among other fac-

tors, revised approaches to parts

supply management.

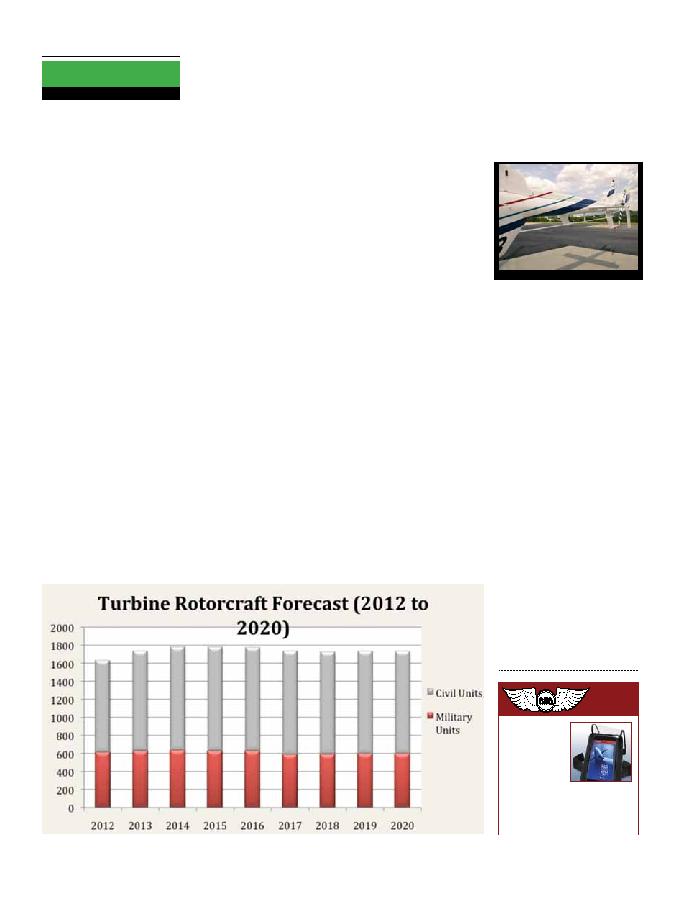

Based on the forecasts of

the existing Rolls Royce 10-year

helicopter market outlook, a

total of 16,970 turbine rotorcraft

deliveries worth $140 billion are

anticipated by 2020, including

10,900 for civil application and

by

Zilvinas Sadauskas

Helicopter News

6,070 for military use. Driving these

orders are enhanced civil market

fundamentals and a growing call by

the world's defence organisations

for the vertical lift capability

afforded by helicopters. Precisely,

recent years have seen a stronger

dependency on helicopters for use

in offshore oil and gas operations,

emergency medical services (EMS)

and by law enforcement agencies.

In addition, what has conventionally

been an industry focused on the

industrialised nations of Europe and

North America has begun to undergo

a shift in its customer base, with

the Asia-Pacific region expected to

dominate expanding sales figures

over the next five years.

What we are seeing here is a

budding recognition of the practical

value served by helicopters. Much

of this is driven by tremendous

advancements in technology over

the past decade, affording both

reductions in operating costs and

improvements to safety and overall

efficiency. Indeed, these forward

strides appear to be acting as a

catalyst for the replacement of aging

helicopter fleets worldwide, affecting

both civil and military segments. In

particular, China's helicopter market,

which is severely underdeveloped at

the current time, is expected to see

double-digit growth over the coming

few years. To place it is perspective,

there are roughly 300 civil rotorcraft

registered in the country today,

as compared to the 8,000 or so

operating in Europe.

Fuelling China's rotorcraft

market is the demand for helicopters

in the country's burgeoning offshore

oil industry. However, the increasing

practicality of helicopters in remote

business engagements is being felt

further afield too. For a number of

years, the growth of the helicopter

sector has outperformed other

segments of the Australian aviation

industry, with the current number of

helicopters forecast to double in as

little as seven years. Conducive to

this growth has been the accelerating

regional demand for the country's

energy and mineral reserves.

The maturing helicopter markets

in emerging economies may also

spell changes to the dominant

players of the industry. For instance,

Eurocopter has been expanding its

sales, production and maintenance

operations in China, reporting an

upshot of 40 percent market share

in the product segments for which it

competes. Furthermore, last week's

highly publicised joint venture

agreement between India's Elcom

Systems and Russian Helicopters

to assemble Mi and Kamov brand

helicopters in India is likely to

shape further change to the industry

dynamics of the region.

With the continued expansion

of the rotorcraft industry comes the

question of component supply. For

many helicopter operators, their

primary business focus has about

as much to do with aviation as a

racehorse has to deep sea diving.

From a functional and cost-saving

perspective, such circumstances

would warrant an integrated

component supply system in order

to save time and deliver prompt

solutions in AOG situations. Indeed,

current e-procurement systems

afford operators the opportunity

to streamline their component

supply process, allowing them to

concentrate on more fundamental

duties, such as emergency

medical relief. ·

Chart 1: Rolls Royce turbine rotorcraft forecast

During January this year Bell

Helicopter, under its Aeronautical

Accessories brand, announced it

had received FAA/STC approval

for an HF Antenna for the Bell 407

helicopter model.

The HF antenna is designed to

interface with many types of HF

radios, thereby increasing reception

in remote areas, improving safety

and communications. A "towel

bar style," the HF antenna runs

the full length of the underside of

the tailboom.

"We are seeing a tremendous

amount of interest in the new Bell

407 HF Antenna Kit," Jennifer

Lunceford, manager, Sales for

Aeronautical Accessories said. "As

helicopters perform missions in

areas beyond the range of traditional

radio equipment, the HF antenna

is required. We are pleased that

Bell Helicopter has received the

STC approval and look forward to

responding to industry demand with

this new product."

Additional information on the

407 HF Antenna Kit is available

on Aeronautical Accessories

website, aero-access.com, or contact

the Aeronautical Accessories

sales team at 1.800.251.7094 or

sales@aero-access.com. ·

Bell Helicopter

receives 407 HF

Antenna STC

approval, available

through Aeronautical

Accessories

GENERAL

PILOT

SUPPLIES

Visit http://www.asa2fly.com/za to view

ASA products, many stocked locally in

Johannesburg, South Africa at General Pilot Supplies.

Tel:+27(0)114624601·Email:mw17@mweb.co.za

GenPilotSupplies-GlobalAviator.indd 1

2/24/12 3:14 PM