10

GA

/ Vol. 5 / No. 2 / FEBRUARY 2013

Changing times:

The future of

national carriers

in Eastern

Europe

The EU-accession of Eastern Euro-

pean states in 2004 and later in 2007

has broadened the scope of airline lib-

eralisation in the region. Unfortunate-

ly however, the increased competition

and free market legislation has forced

many of these small-sized carriers

into precarious financial situations.

The looming bankruptcy concerns we

are seeing for both Estonian Air and

airBaltic come only after the collapse

of Air Slovakia, Malév Hungarian

Airlines and more recently, Poland's

OLT Express. Other carriers are not

faring particularly well either, with

Czech Airlines and LOT struggling

to turn around after years of ongo-

ing losses and aggressive competi-

tion from low cost airlines. Staving

off future insolvency could prove a

formidable task, but there are certain

avenues airlines may take to improve

their overall competitiveness.

Prior to EU-accession, most

of the state-owned flag carriers

of Eastern Europe were either

profitable or sustained losses within

relatively narrow margins. While

EU membership afforded greater

network capacity for the airlines,

it also led to heightened volatility

of annual returns, resulting in

record annual losses, including

a 1.5bil loss for Czech Airlines

in 2009, a 78.0 mil loss for the

Romanian carrier, Tarom in 2010

and a 17.3 mil loss for Estonian

Air as of last year. Meanwhile, low

cost competition from the likes of

Ryanair, Wizz Air and EasyJet have

procured substantial market share

by expanding their activities into

the newly opened markets of the

East. Indeed, the past five years have

shown nothing but ongoing annual

losses for the majority of legacy

carriers in the region, with a further

decline projected unless drastic

structural reforms are sought.

`The current Eurozone crisis

has not levelled favourable results

among airlines in Europe. It appears

however, that Western European

airlines have managed to weather the

downturn reasonably better. Looking

into their developments, one may

notice the handful of mergers taking

place over recent years, including

Air France with KLM in 2004 and

British Airways with Iberia in 2011.

This has allowed them to achieve

economies of density and to rid

double marginalisation, generating

both competitive fares and lower

marginal costs. It is through similar

cost synergies as these that airlines in

the Eastern states may seek a future

revival and regain some of their

competitiveness,' comments the CEO

of AviationCV.com, Skaiste Knyzaite.

Currently, most airlines in

Eastern Europe remain under the

ownership and regulation of national

institutions. The failure to separate

these two functions in the open

aviation market of today does not lend

well to balancing the books of many

of these struggling carriers. Clearly,

wide public support still remains in

preserving the national interests of

these legacy airlines.

For the interim however,

airlines in Eastern Europe may seek

alternative ways at stemming their

growing cost profiles. One of these

ways is through outsourcing certain

factors, such as recruitment, IT or

back office operations. S. Knyzaite

asserts that `While outsourcing has

traditionally been seen as merely

a cost cutting exercise, today's

strategic partnerships in the airline

industry also serve to achieve

ongoing efficiencies and operational

improvements. For instance, contract

personnel provided through crew

leasing agencies affords greater

flexibility in line with seasonal

variations, thereby avoiding excess

staffing costs during the low season.

In addition, such partnerships ensure a

steady stream of qualified personnel if

and when they are needed, enhancing

overall competitiveness.' ·

By AviationCV.com

Airline News

Boeing has commended the Senate for

its approval of legislation previously

enacted by the House that establishes

Permanent Normal Trade Relations

(PNTR) with Russia.

Boeing's CEO, Jim McNerney

said that the action by the Senate

sends long-sought legislation to

the president's desk that offers

enormous opportunity for U.S.

exports, economic growth and jobs.

He commended Senators Reid and

McConnell for bringing legislation

already passed by the House to the

Senate floor, as well as Senators

Baucus, Hatch, Kerry, Thune and

McCain for their long standing

support of Russia PNTR.

Russia is a nation rich in natural

resources with a $1.9 trillion economy.

In 2011 it imported more than $400

billion of goods and services. It is a

growing market that offers significant

opportunity for workers in a broad

range of American industries

telecommunications, energy,

agriculture, chemicals, machinery,

medical equipment and aerospace, to

name just a few.

Boeing forecasts that Russian

airlines will purchase some 900

commercial airplanes over the

next 20 years, a market valued at

approximately $100 billion.

McNerney has urged President

Obama to sign this important

legislation without delay. Russia has

made significant concessions to join

the World Trade Organization and

the governments of 155 other nations

have already normalized trade

relations with Russia. McNerney

said that the U.S. should do the same

to ensure that American exporters

and their employees have the

same advantages as their foreign

competitors when doing business

in Russia. ·

Boeing commends senate action supporting U.S. exports to Russia

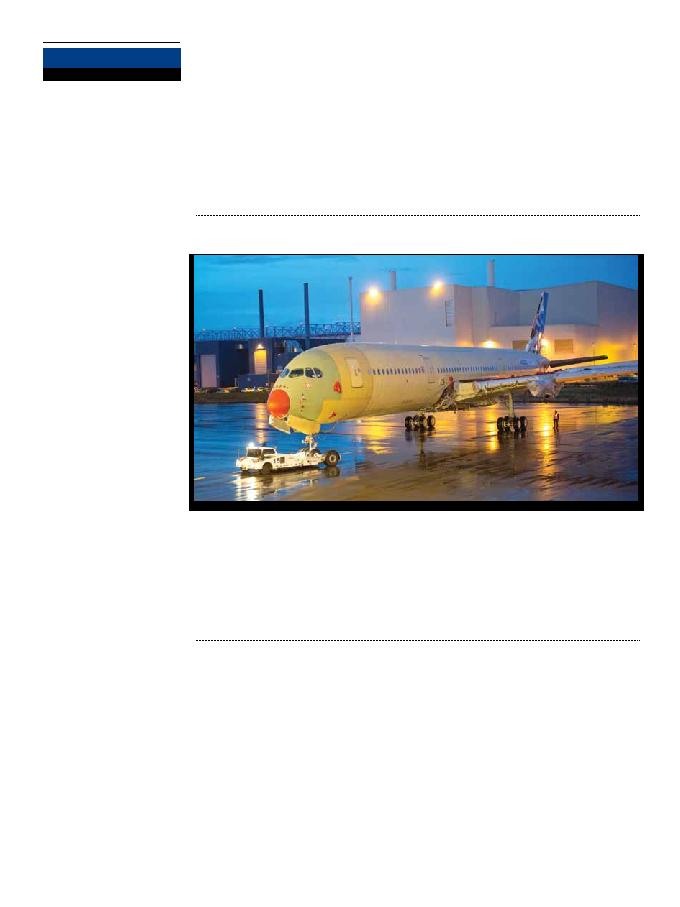

First flyable A350 XWB "MSN1" structurally complete

Airbus has successfully completed

the main structural assembly and

system connection of A350 XWB

`MSN1' the first flight-test aircraft.

The aircraft is depicted here on its

wheels for the very first time moving

out of the main assembly hall (Station

40) at the recently inaugurated

"Roger Béteille" A350 XWB Final

Assembly Line in Toulouse. It

then entered the adjacent indoor

ground test station (Station 30).

The assembly work performed

in Station 40 included the successful

electrical power-on of the aircraft's

entire fuselage and wings. Soon work

in Station 30 will start by testing the

aircraft's hydraulic system, followed

by the full electric and hydraulic

power-on of the aircraft which will

be completed by around the end of

the year. This will mark the start

of several weeks of comprehensive

functional system testing.

After the A350 XWB MSN1

exits station 30, the aircraft will

go through a series of extensive

production and certification /

development tests, be painted and

have its engines installed. It will

then be delivered to the flight-line

and be readied for its first flight in

mid-2013.

© A

i

r

b

u

s S

.

A

.

S

. 2

0

1

2 - p

h

o

t

o b

y P

. M

a

s

c

l

e

t