1 4 · d e t e k t o r i n t e r n a t i o n a l

Security News Every Day

www. securityworldhotel.com

security

technology market

"Offering a relatively inexpensive

solution compared to trenching

cable, wireless infrastructure deliv-

ers a low-cost option for those

who that want to establish surveil-

lance networks," said Josh Wood-

house, video surveillance analyst

at IHS. "In regions with wide-

spread existing video surveillance

infrastructure, such as the United

States or the United Kingdom, the

adoption of wireless infrastructure

for video surveillance is growing

steadily. However, emerging re-

gions that lack such infrastructure

will generate the strongest growth

MarketforWirelessInfrastructureGearfor

VideoSurveillanceSettoMorethanDoubleby2016

London, UK

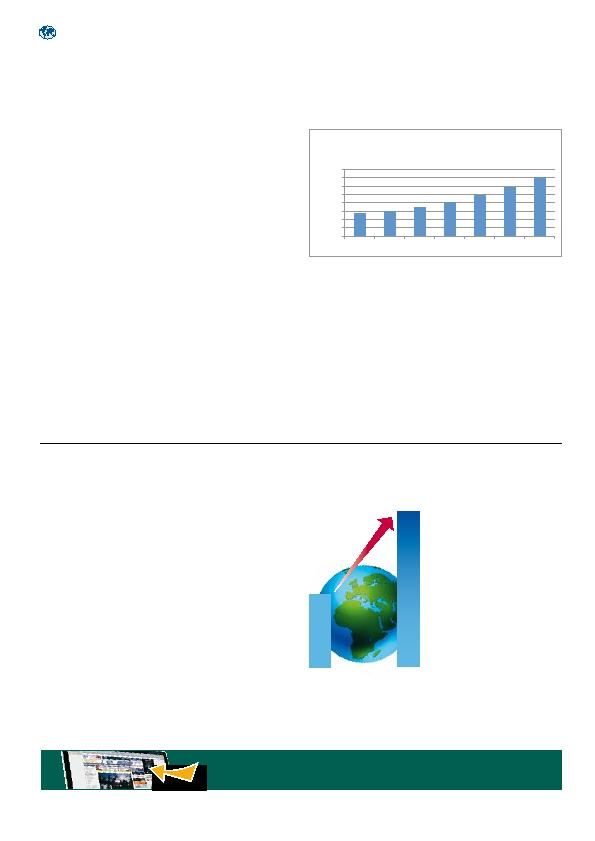

The global market for wireless infrastructure gear used

for video surveillance applications is set to more than

double from 2011 to 2016, with a significant amount of

growth driven by demand for low-cost systems in emerg-

ing economies like China and India. worldwide revenue for

such equipment will soar to $705 million in 2017, up nearly

160 percent from $274 million in 2011, according to a new

report published by IMS Research, now part of IHS Inc.

(NYSE: IHS). After increasing by 11 percent in 2012, growth

will accelerate to 15 percent in 2013, with revenue reaching

$350 million, as presented in the attached figure.

in the world, causing the market

for video surveillance wireless in-

frastructure gear to boom during

the coming years."

Keeping an eye on video

surveillance in different

regions

The global market for wireless

infrastructure gear for video

surveillance is expected to expand

at a compound annual growth rate

(CAGR) of 17 percent from 2011

through 2017. Global growth will

be led by China, with a stunning

28.8 percent revenue CAGR dur-

ing the period. The next fastest-

growing region will be the rest of

the Asia region an area including

India which will increase by

27.9 percent. Mexico is set for a

23.1 percent CAGR, Brazil will

rise by 17.4 percent, and the rest

of South America will increase by

26.6 percent.

Asia goes for

wireless surveillance

The Asian market is currently the

smallest and least developed region

for wireless infrastructure gear for

video surveillance. However, Asia is

forecast to grow the fastest among

all global areas in the coming years,

thanks to the region's lack of any

existing wired surveillance infra-

structure, combined with the low

cost of wireless and the booming

demand for security.

Cisco leads the market

Cisco Systems Inc. was the leading

supplier of wireless infrastructure

gear used in video surveillance in

2012, with an 11.7 percent share

of global market revenue.

0

100

200

300

400

500

600

700

800

2011

2012

2013

2014

2015

2016

2017

Millions

of

U

.S.

Dollar

s

IHS

Figure:

Global

Forecast

of

Market

Revenue

for

Wireless

Intrastructure

used

for

Video

Surveillance

(Millions

of

U.S.

Dollars)

Frost&Sullivanpredictsglobalshifttooutsourcingsecurity

London, UK

New analysis from Frost & Sullivan entitled, Analy-

sis of the Global Managed Security Services Market,

finds that the market will be around USd 66.25 billion

in 2012 and estimates this to increase to USD 139.10

billion by 2021. The research covers two key service

segments: physical and IT security.

The increasing complexity of both

IT and physical security require-

ments for commercial and govern-

ment organisations will drive a shift

towards outsourcing security to

managed security service providers

(MSSPs). Adopting an outsourced

model reduces the need for in-

house provision and can provide

the most cost-efficient approach to

an organisations' security.

"In current times, many

organisations remain highly cost-

conscious, motivating them to

outsource their security require-

ments and reduce operating

costs," noted Frost & Sullivan

Aerospace & Defence Research

Analyst Anthony Leather. "Even

while security remains a priority

for organsiations, chief decision

makers are looking to the industry

to provide them with the most

advanced security solutions at the

most competitive prices."

The growing threat and com-

plexity of attacks, especially in the

IT segment, is spurring greater

investment in new and existing

solutions to ensure both physical

and network security. Shifting

security operations to MSSPs

enables organsiations to outsource

progressively more complex secu-

rity requirements to the experts,

while focusing on their own core

business processes.

While there are cost-efficiencies

to be gained through a security out-

sourcing model, some organisations

still prefer to keep security in-house.

This allows them to address issues

immediately, without relying on

outside companies.

"A common concern among

security managers is the wide range

of companies that MSSPs have to

monitor," added Leather. "This might

result in the untimely handling of

security breaches or incidents."

Focusing on the larger markets,

such as North America and Europe

where outsourcing security services

is a more accepted practice, will

help build market share and a strong

customer base for companies. This

trend is expected to spread to other

regions.

2012

$66.25

billion

$139.10

billion

2021

Business & Product News Every Day!

www.securityworldhotel.com