Form 990 (2011)

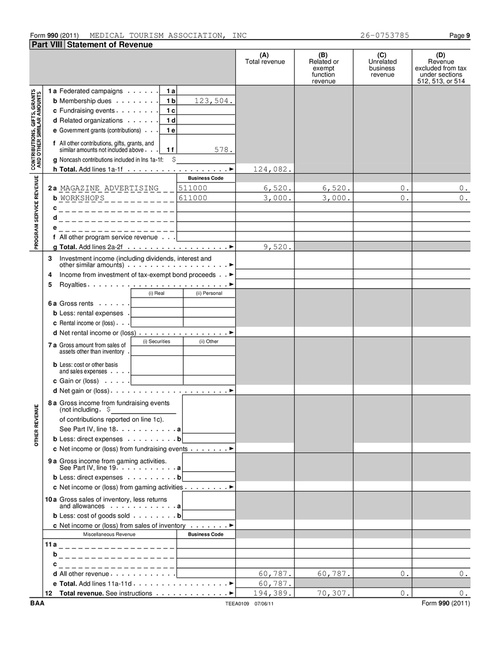

MEDICAL TOURISM ASSOCIATION, INC Part VIII Statement of Revenue

(A) Total revenue (B) Related or exempt function revenue

26-0753785

(C) Unrelated business revenue

Page 9 (D) Revenue excluded from tax under sections 512, 513, or 514

1a b c d e

Federated campaigns Membership dues Fundraising events Related organizations Government grants (contributions)

1a 1b 1c 1d 1e

123,504.

f All other contributions, gifts, grants, and similar amounts not included above 1f g Noncash contributions included in lns 1a-1f: $ h Total. Add lines 1a-1f 2 a MAGAZINE ADVERTISING b WORKSHOPS c d e f All other program service revenue g Total. Add lines 2a-2f 3 4 5 6a b c d

578. 124,082.

Business Code

511000 611000

6,520. 3,000.

6,520. 3,000.

0. 0.

0. 0.

9,520.

Investment income (including dividends, interest and other similar amounts) Income from investment of tax-exempt bond proceeds Royalties

(i) Real (ii) Personal

Gross rents Less: rental expenses Rental income or (loss) Net rental income or (loss)

(i) Securities (ii) Other

7 a Gross amount from sales of assets other than inventory b Less: cost or other basis and sales expenses c Gain or (loss) d Net gain or (loss)

8 a Gross income from fundraising events (not including $ of contributions reported on line 1c). See Part IV, line 18 a b Less: direct expenses b c Net income or (loss) from fundraising events 9 a Gross income from gaming activities. See Part IV, line 19 a b Less: direct expenses b c Net income or (loss) from gaming activities 10 a Gross sales of inventory, less returns and allowances a b Less: cost of goods sold b c Net income or (loss) from sales of inventory

Miscellaneous Revenue Business Code

11 a b c d All other revenue e Total. Add lines 11a-11d 12 Total revenue. See instructions BAA

TEEA0109

60,787. 60,787. 194,389.

07/06/11

60,787. 70,307.

0. 0.

0. 0.

Form 990 (2011)