Schedule F (Form 990) 2011

MEDICAL TOURISM ASSOCIATION, INC

26-0753785

Page 4

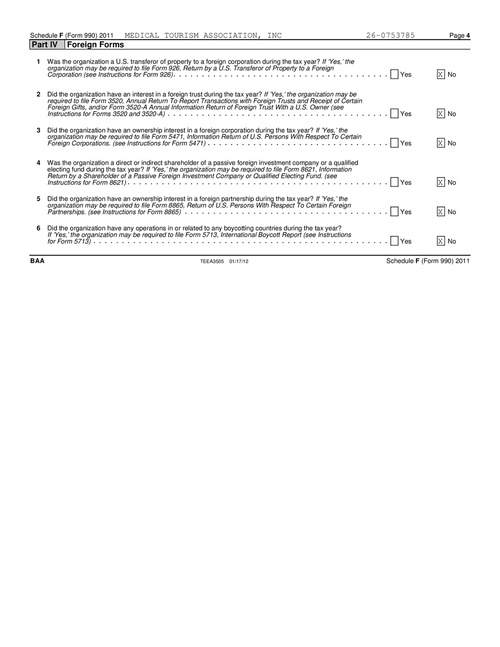

Part IV

1

Foreign Forms

Was the organization a U.S. transferor of property to a foreign corporation during the tax year? If ’Yes,’ the organization may be required to file Form 926, Return by a U.S. Transferor of Property to a Foreign Corporation (see Instructions for Form 926) Did the organization have an interest in a foreign trust during the tax year? If ’Yes,’ the organization may be required to file Form 3520, Annual Return To Report Transactions with Foreign Trusts and Receipt of Certain Foreign Gifts, and/or Form 3520-A Annual Information Return of Foreign Trust With a U.S. Owner (see Instructions for Forms 3520 and 3520-A) Did the organization have an ownership interest in a foreign corporation during the tax year? If ’Yes,’ the organization may be required to file Form 5471, Information Return of U.S. Persons With Respect To Certain Foreign Corporations. (see Instructions for Form 5471) Was the organization a direct or indirect shareholder of a passive foreign investment company or a qualified electing fund during the tax year? If ’Yes,’ the organization may be required to file Form 8621, Information Return by a Shareholder of a Passive Foreign Investment Company or Qualified Electing Fund. (see Instructions for Form 8621) Did the organization have an ownership interest in a foreign partnership during the tax year? If ’Yes,’ the organization may be required to file Form 8865, Return of U.S. Persons With Respect To Certain Foreign Partnerships. (see Instructions for Form 8865) Did the organization have any operations in or related to any boycotting countries during the tax year? If ’Yes,’ the organization may be required to file Form 5713, International Boycott Report (see Instructions for Form 5713)

TEEA3505 01/17/12

Yes

X

No

2

Yes

X

No

3

Yes

X

No

4

Yes

X

No

5

Yes

X

No

6

Yes

X

No

BAA

Schedule F (Form 990) 2011