TEEA3302 02/02/10

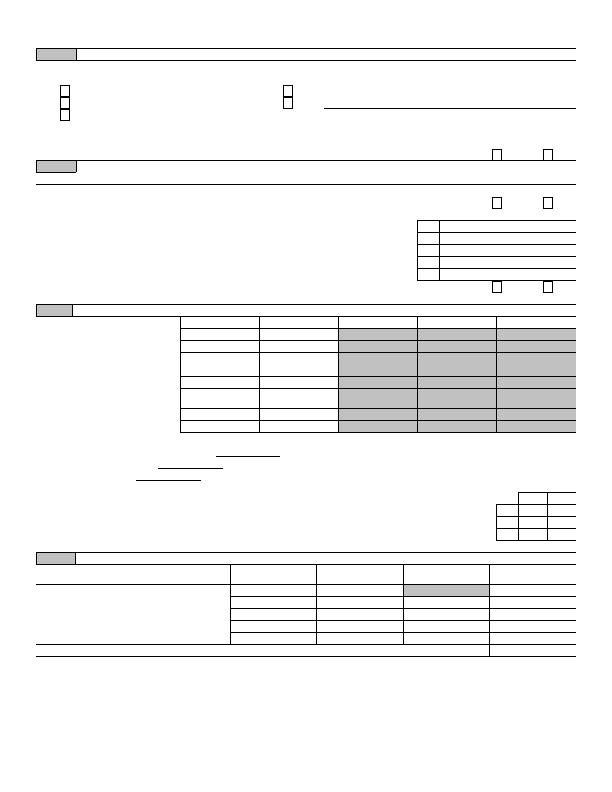

Part III Organizations Maintaining Collections of Art, Historical Treasures, or Other Similar Assets (continued)

3

Using the organization's acquisition accession and other records, check any of the following that are a significant use of its collection

items (check all that apply):

a

Public exhibition

d

Loan or exchange programs

b

Scholarly research

e

Other

c

Preservation for future generations

4

Provide a description of the organization's collections and explain how they further the organization's exempt purpose in

Part XIV.

5

During the year, did the organization solicit or receive donations of art, historical treasures, or other similar

assets to be sold to raise funds rather than to be maintained as part of the organization's collection?

. . . . . . . . . . . . . . .

Yes

No

Part IV Escrow and Custodial Arrangements Complete if organization answered 'Yes' to Form 990, Part IV, line

9, or reported an amount on Form 990, Part X, line 21.

1 a Is the organization an agent, trustee, custodian, or other intermediary for contributions or other assets not

included on Form 990, Part X?

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

b If 'Yes,' explain the arrangement in Part XIV and complete the following table:

Amount

c Beginning balance

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1 c

d Additions during the year

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1 d

e Distributions during the year

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1 e

f Ending balance

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1 f

2 a Did the organization include an amount on Form 990, Part X, line 21?

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

b If 'Yes,' explain the arrangement in Part XIV.

Schedule D (Form 990) 2009

Page 2

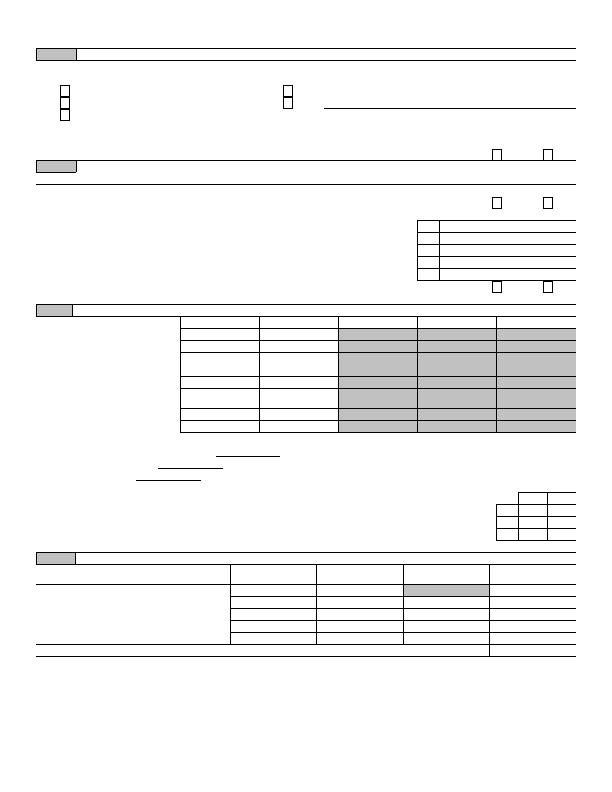

Part V Endowment Funds Complete if organization answered 'Yes' to Form 990, Part IV, line 10.

(a) Current year

(b) Prior year

(c) Two years back

(d) Three years back

(e) Four years back

1 a Beginning of year balance

. . . . . .

b Contributions

. . . . . . . . . . . . . . . . . .

c Net Investment earnings, gains,

and losses

. . . . . . . . . . . . . . . . . . . .

d Grants or scholarships

. . . . . . . . .

e Other expenditures for facilities

and programs

. . . . . . . . . . . . . . . . .

f Administrative expenses

. . . . . . .

g End of year balance

. . . . . . . . . . .

2

Provide the estimated percentage of the year end balance held as:

a Board designated or quasi-endowment G

%

b Permanent endowment G

%

c Term endowment G

%

3 a Are there endowment funds not in the possession of the organization that are held and administered for the

organization by:

Yes

No

(i) unrelated organizations

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3a(i)

(ii) related organizations

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3a(ii)

b If 'Yes' to 3a(ii), are the related organizations listed as required on Schedule R?

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3b

4

Describe in Part XIV the intended uses of the organization's endowment funds.

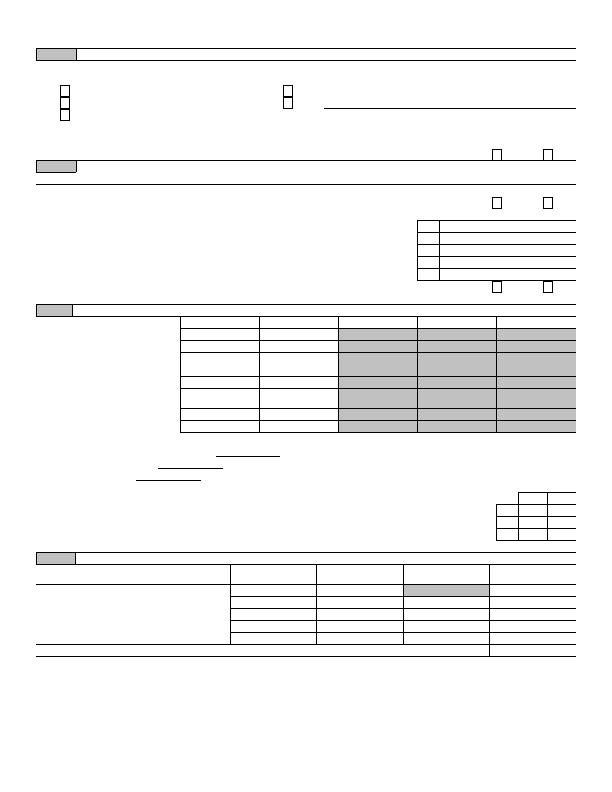

Part VI Investments

'Land, Buildings, and Equipment. See Form 990, Part X, line 10.

Description of investment

(a) Cost or other basis

(investment)

(b) Cost or other

basis (other)

(c) Accumulated

Depreciation

(d) Book Value

1 a Land

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

b Buildings

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

c Leasehold improvements

. . . . . . . . . . . . . . . . . . .

d Equipment

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

e Other

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Total. Add lines 1a through 1e (Column (d) must equal Form 990, Part X, column (B), line 10(c).)

. . . . . . . . . . . . . . . . . . . . .

G

BAA

Schedule D (Form 990) 2009

MEDICAL TOURISM ASSOCIATION, INC

26-0753785

12,824.

6,563.

6,261.

6,261.