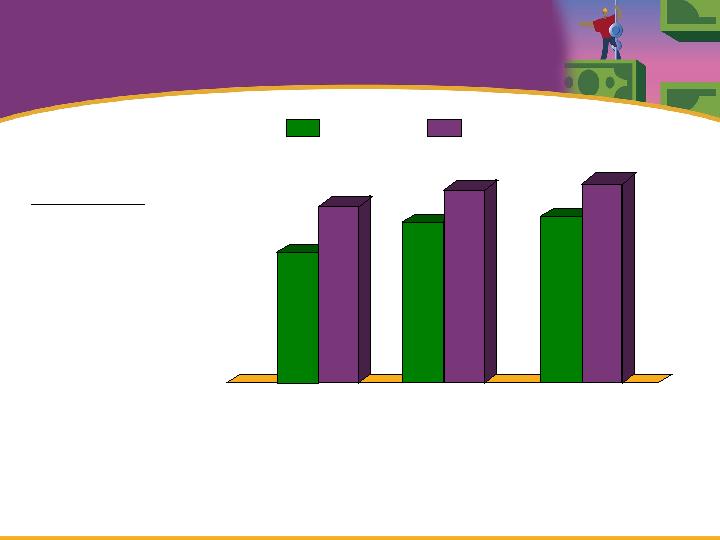

Annuity payments

+ portfolio

withdrawals =

4.5% of initial

portfolio, adjusted

for inflation

no annuity

25% annuitized

The probability of

sustaining

withdrawals from

non-annuitized

portion of the

portfolio

for 30

years using varying

stock/bond/cash

allocations

Conservative

20%/50%/30%

Balanced

40%/40%/20%

Growth

60%/30%/10%

70%

81%

82%

87%

91%

90%

Results from "The Retirement Probability Analyzer "by

Moshe Milevsky and the Society of Actuaries, which

computes probabilities associated with various

retirement investment and spending strategies.

Results may vary over time and each time the simulation is run. IMPORTANT: The projections or other information generated by the authors of

the article regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results and, are

not guarantees of future results.

This is for illustrative purposes only and not indicative of any investment. An

investment cannot be made directly in an index. Analysis assumes after-inflation

returns of 7% stock/18% standard deviation, 3% bond/10% standard deviation,

0.5% money market funds. Past performance is no guarantee of future results.

A combination of SWP and annuitization

may increase savings longevity