types of assets in a manner that is non-recourse (or limited recourse) to the sponsor of the project and where

only the cash flow from the specific assets, typically isolated in a special-purpose vehicle, is used to service

the project debt secured by those assets.

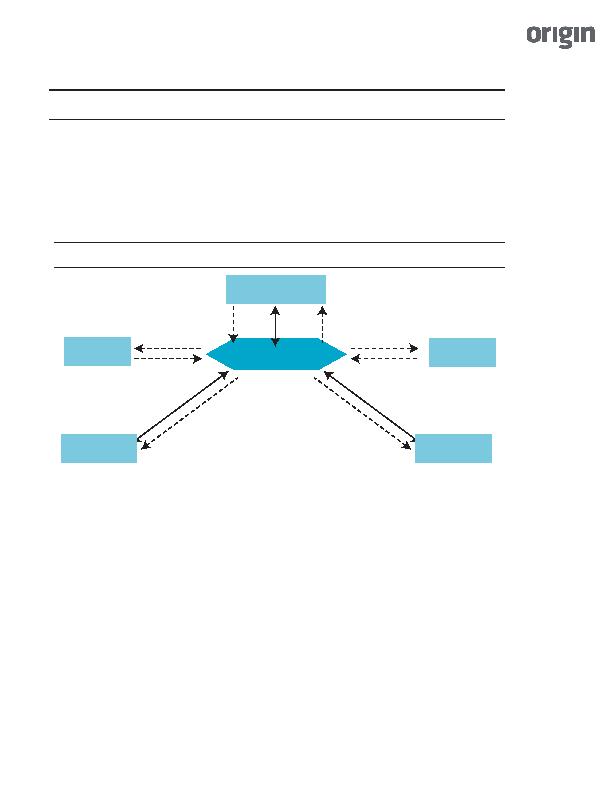

(2) operating period and (3) sponsorship, financial, legal and other considerations. The following schematic

shows the typical contractual and cash flow relationships in a project financing.

Project finance structures rely on contracts to manage risk during construction and operation. Project assets

are typically held in a special purpose vehicle (SPV), here labeled "ProjectCo". The engineering,

procurement and construction contract (EPC) sets out the terms of construction of the project, typically at a

fixed price. The revenue contract (e.g., a power purchase agreement (PPA)) permits ProjectCo to sell its

output (e.g., electricity) to the off-taker or revenue counterparty. The operating and maintenance (O&M)

agreement sets out the terms of services provided by the O&M contractor(s) and sub-contractors during the

operating period. Finally, a variety of financial agreements (trust indentures, hedging agreements) and SPV

constitution documents address certain financial, legal and other considerations. The terms of the

contracts typically transfer, or partially transfer, a variety of risks from ProjectCo to its counterparties in the

transaction. Such risks include construction completion risks, the credit risk of various counterparties,

operational risks, price and inflation risks as well as catastrophic risks, each of which are typically trans-

ferred to the entity best able to bear them. These risks and others are discussed in detail in the sections that

follow.