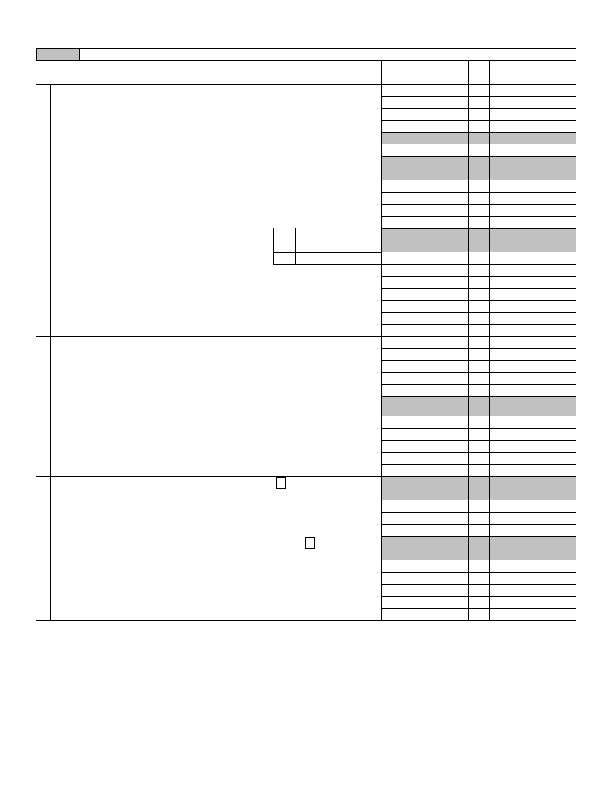

Form 990 (2010)

Page 11

TEEA0111 12/21/10

1

Cash ' non-interest-bearing

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

2

Savings and temporary cash investments

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

3

Pledges and grants receivable, net

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

4

Accounts receivable, net

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

5

Receivables from current and former officers, directors, trustees, key employees,

and highest compensated employees. Complete Part II of Schedule L

. . . . . . . . . . . . .

5

6

Receivables from other disqualified persons (as defined under section 4958(f)(1)),

persons described in section 4958(c)(3)(B), and contributing employers and

sponsoring organizations of section 501(c)(9) voluntary employees' beneficiary

organizations (see instructions)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

7

Notes and loans receivable, net

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

8

Inventories for sale or use

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

A

S

S

E

T

S

9

Prepaid expenses and deferred charges

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

10 a Land, buildings, and equipment: cost or other basis.

Complete Part VI of Schedule D

. . . . . . . . . . . . . . . . . . . .

10 a

b Less: accumulated depreciation.

. . . . . . . . . . . . . . . . . . . .

10 b

10 c

11

Investments ' publicly traded securities

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11

12

Investments ' other securities. See Part IV, line 11

. . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12

13

Investments ' program-related. See Part IV, line 11

. . . . . . . . . . . . . . . . . . . . . . . . . . . .

13

14

Intangible assets

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14

15

Other assets. See Part IV, line 11

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15

16

Total assets. Add lines 1 through 15 (must equal line 34)

. . . . . . . . . . . . . . . . . . . . . . . .

16

Part X

Balance Sheet

(A)

Beginning of year

(B)

End of year

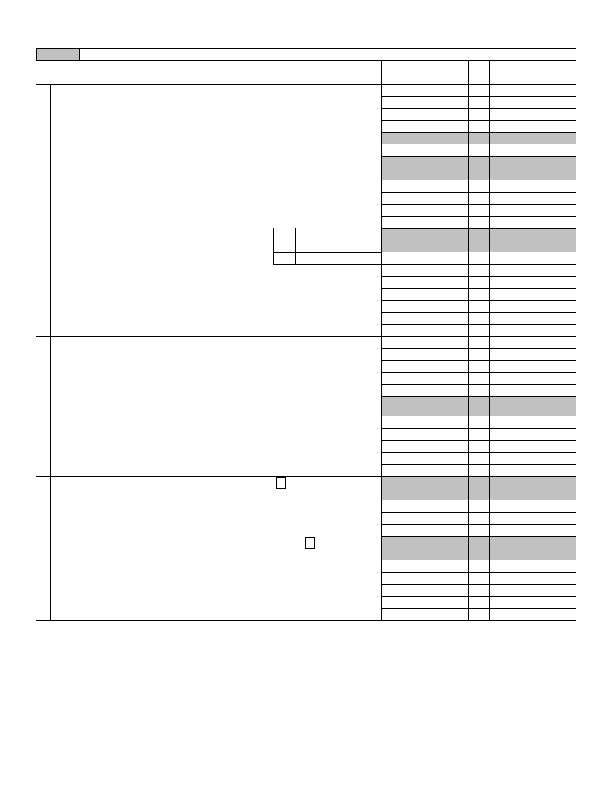

Organizations that follow SFAS 117, check here

G

and complete lines

27 through 29 and lines 33 and 34.

27

Unrestricted net assets

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

27

28

Temporarily restricted net assets

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

28

29

Permanently restricted net assets

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

29

Organizations that do not follow SFAS 117, check here

G

and complete

lines 30 through 34.

30

Capital stock or trust principal, or current funds

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

30

31

Paid-in or capital surplus, or land, building, or equipment fund

. . . . . . . . . . . . . . . . . . .

31

32

Retained earnings, endowment, accumulated income, or other funds

. . . . . . . . . . . . .

32

33

Total net assets or fund balances.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

33

N

E

T

A

S

S

E

T

S

O

R

F

U

N

D

B

A

L

A

N

C

E

S

34

Total liabilities and net assets/fund balances.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

34

17

Accounts payable and accrued expenses

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17

18

Grants payable

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

18

19

Deferred revenue

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

19

20

Tax-exempt bond liabilities

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

20

21

Escrow or custodial account liability. Complete Part IV of Schedule D

. . . . . . . . . . . .

21

22

Payables to current and former officers, directors, trustees, key employees,

highest compensated employees, and disqualified persons. Complete Part II

of Schedule L

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

22

23

Secured mortgages and notes payable to unrelated third parties

. . . . . . . . . . . . . . . . . .

23

24

Unsecured notes and loans payable to unrelated third parties

. . . . . . . . . . . . . . . . . . . .

24

25

Other liabilities. Complete Part X of Schedule D

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

25

L

I

A

B

I

L

I

T

I

E

S

26

Total liabilities. Add lines 17 through 25

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

26

BAA

Form 990 (2010)

MEDICAL TOURISM ASSOCIATION, INC

26-0753785

7,830.

35,032.

21,489.

8,587.

6,261.

12,902.

2,970.

2,753.

17,061.

50,687.

0.

15,000.

0.

15,000.

X

17,061.

35,687.

17,061.

35,687.

17,061.

50,687.