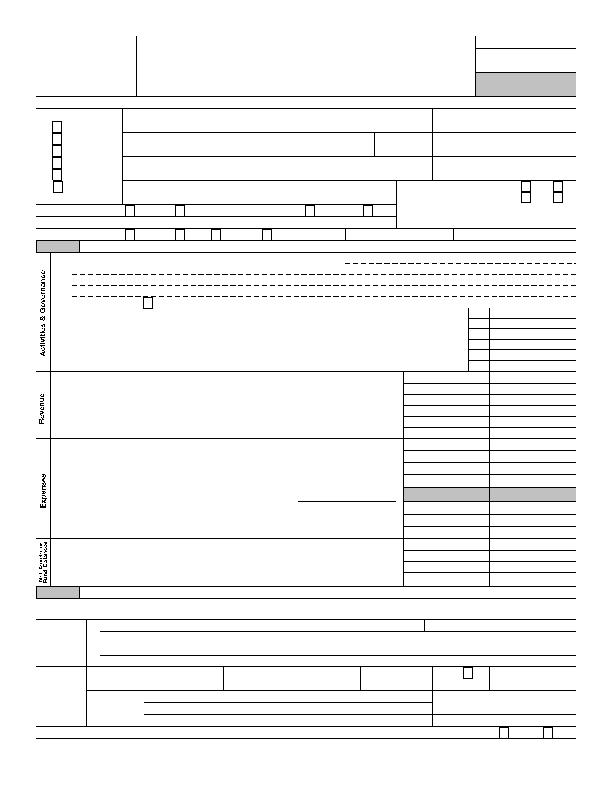

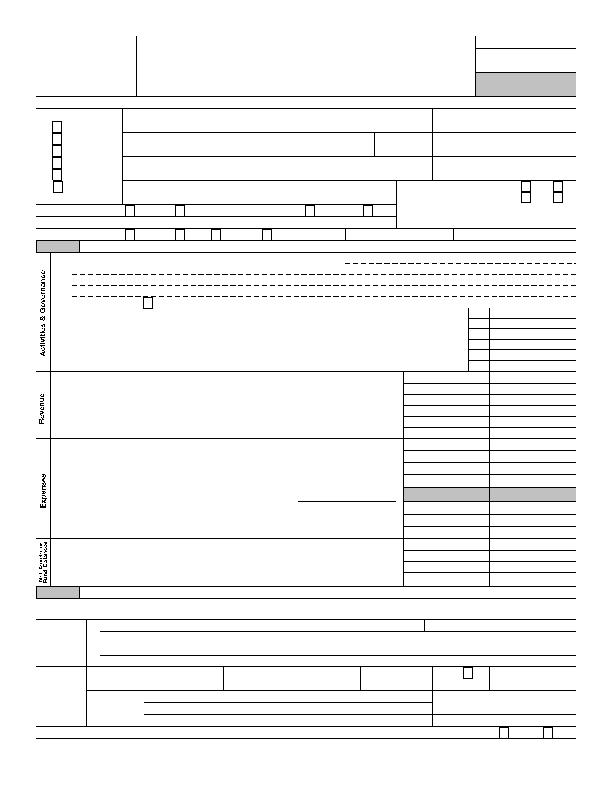

A

For the 2010 calendar year, or tax year beginning

, 2010, and ending

,

B

Check if applicable:

C

Name of organization

D

Employer Identification Number

Address change

Doing Business As

Name change

Number and street (or P.O. box if mail is not delivered to street addr)

Room/suite

E

Telephone number

Initial return

Terminated

City, town or country

State

ZIP code + 4

Amended return

G

Gross receipts

$

Part I

Summary

1

Briefly describe the organization's mission or most significant activities:

2

Check this box G

if the organization discontinued its operations or disposed of more than 25% of its net assets.

3

Number of voting members of the governing body (Part VI, line 1a)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

4

Number of independent voting members of the governing body (Part VI, line 1b)

. . . . . . . . . . . . . . . . . . . . . . . . .

4

5

Total number of individuals employed in calendar year 2010 (Part V, line 2a)

. . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

6

Total number of volunteers (estimate if necessary)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

7 a Total unrelated business revenue from Part VIII, column (C), line 12

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7 a

b Net unrelated business taxable income from Form 990-T, line 34

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7 b

OMB No. 1545-0047

Form

990

Return of Organization Exempt From Income Tax

Under section 501(c), 527, or 4947(a)(1) of the Internal Revenue Code

(except black lung benefit trust or private foundation)

2010

Department of the Treasury

Internal Revenue Service

G

The organization may have to use a copy of this return to satisfy state reporting requirements.

Open to Public

Inspection

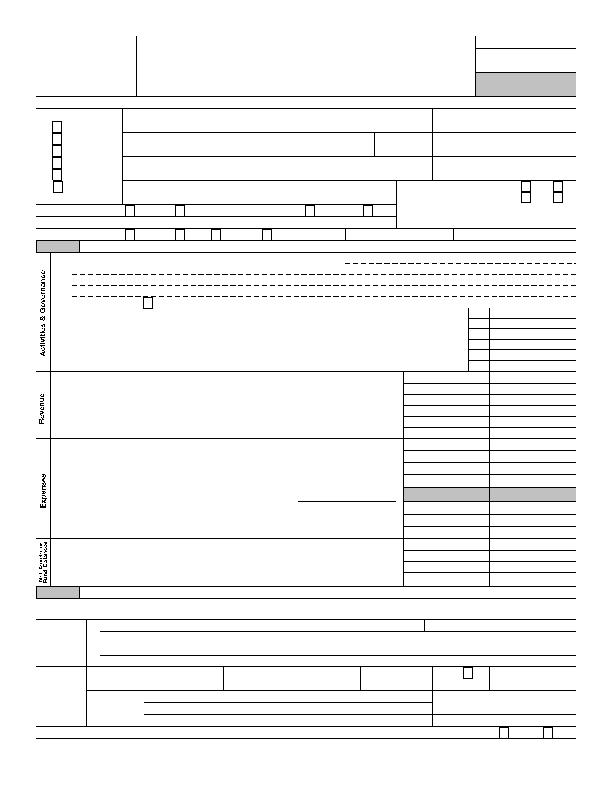

Part II

Signature Block

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct, and

complete. Declaration of preparer (other than officer) is based on all information of which preparer has any knowledge.

A

Signature of officer

Date

Sign

Here

A

Type or print name and title.

Print/Type preparer's name

Preparer's signature

Date

Check

if

PTIN

self-employed

Firm's name

G

Firm's address

G

Firm's EIN

G

Paid

Preparer

Use Only

Phone no.

May the IRS discuss this return with the preparer shown above? (see instructions)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

BAA For Paperwork Reduction Act Notice, see the separate instructions.

TEEA0101 03/25/11

Form 990 (2010)

Prior Year

Current Year

8

Contributions and grants (Part VIII, line 1h)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

Program service revenue (Part VIII, line 2g)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10

Investment income (Part VIII, column (A), lines 3, 4, and 7d)

. . . . . . . . . . . . . . . . . . . . . . . . . .

11

Other revenue (Part VIII, column (A), lines 5, 6d, 8c, 9c, 10c, and 11e)

. . . . . . . . . . . . . . . . .

12

Total revenue ' add lines 8 through 11 (must equal Part VIII, column (A), line 12)

. . . . . .

13

Grants and similar amounts paid (Part IX, column (A), lines 1-3)

. . . . . . . . . . . . . . . . . . . . . . .

14

Benefits paid to or for members (Part IX, column (A), line 4)

. . . . . . . . . . . . . . . . . . . . . . . . . .

15

Salaries, other compensation, employee benefits (Part IX, column (A), lines 5-10)

. . . . . .

16 a Professional fundraising fees (Part IX, column (A), line 11e)

. . . . . . . . . . . . . . . . . . . . . . . . . . .

b Total fundraising expenses (Part IX, column (D), line 25) G

17

Other expenses (Part IX, column (A), lines 11a-11d, 11f-24f)

. . . . . . . . . . . . . . . . . . . . . . . . . .

18

Total expenses. Add lines 13-17 (must equal Part IX, column (A), line 25)

. . . . . . . . . . . . . .

19

Revenue less expenses. Subtract line 18 from line 12

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Beginning of Current Year

End of Year

20

Total assets (Part X, line 16)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

21

Total liabilities (Part X, line 26)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

22

Net assets or fund balances. Subtract line 21 from line 20

. . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Application pending

F

Name and address of principal officer:

I

Tax-exempt status

501(c)(3)

501(c) (

)H

(insert no.)

4947(a)(1) or

527

J

Website:

G

H(a) Is this a group return for affiliates?

H(b) Are all affiliates included?

K

Form of organization:

Corporation

T

rust

Association

Other

G

L

Year of Formation:

M

State of legal domicile:

If 'No,' attach a list. (see instructions)

H(c) Group exemption number

G

Yes

No

Yes

No

MEDICAL TOURISM ASSOCIATION, INC

10130 NORTHLAKE BOULEVARD

214-315

WEST PALM BEACH

FL 33412

26-0753785

(561) 791-2000

JONATHAN EDELHEIT 10130 NORTHLAKE BOULEVA

WEST PALM BEACH

FL 33412

522,349.

X

X

6

www.MedicalTourismAssociation.com

X

2007

FL

EDUCATION & PROMOTION OF GLOBAL HEALTHCARE

5

3

10

10

0.

312,453.

219,696.

228,008.

246,653.

84,752.

56,000.

625,213.

522,349.

172,636.

206,283.

445,142.

297,440.

617,778.

503,723.

7,435.

18,626.

17,061.

50,687.

0.

15,000.

17,061.

35,687.

JONATHAN EDELHEIT

President

RAYMOND V STEPHANO, CPA, CFS

Raymond V. Stephano, P.C., CPA

550 Pinetown Road Suite 303

Fort Washington

PA 19034

(215) 283-5210

X